Billing Information & Taxes

Your billing information is required to create invoices. Once you create a campaign, you need to add billing details. Just in case there is a change in the existing billing information, you can update the same in a few easy steps.

- Sign in, go to top right and click profile menu > Billing Information.

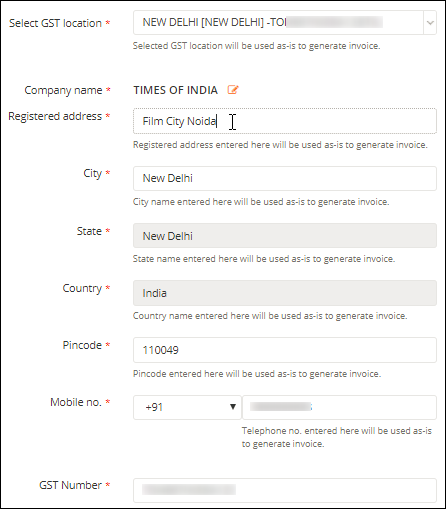

- Select a GST location (for Indian users only).

- Update registered address, city, pin code, and mobile number.

- If required, update GST number (for Indian users only).

- Click Update.

Once you have updated the billing information, it will be saved and updated in real-time. Invoices will be generated on your last updated billing information.

Add a New GST Location:

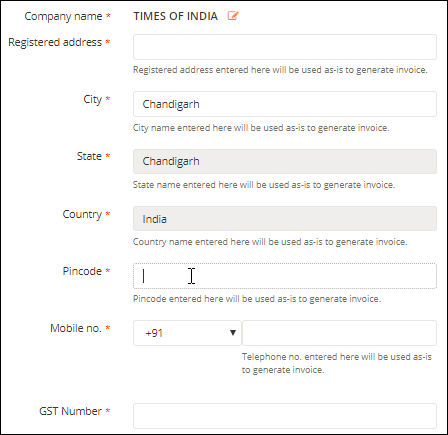

For Indian users, if GST location do not exist in billing information, then you can add a new location using these steps.

- Sign in, go to top right and click profile menu > Billing Information.

- Click Add new GST Location.

- Enter Registered Address, City, Pin code, Mobile No, and GST Number.

- Click Add.

You cannot add multiple GST locations for a single state. But you can update the GST number of any state while updating the billing information.

Taxes:

- 15% service tax is applicable per transaction in case of INR.

- Service tax is not levied in case of foreign currency (USD).